HEALTH

Commonwealth Report Calls for More Nuanced Single-Payer

A new Commonwealth Fund report concluded that the most prominent features of U.S. single-payer proposals — a centralized financial and regulatory system, expanded public insurance and the elimination of private coverage — “are not the norm across nations that have achieved universal coverage.” NYU’s Sherry Glied and colleagues compared universal coverage systems from Denmark to Taiwan in three key areas: the respective roles of national, regional, and local government; the benefits covered and the share of costs patients bear; and the role private insurance plays. Glied says “a more nuanced understanding” of how other countries approach health care would give policymakers here more options. Fingers crossed that Bernie and AOC get their copies. But you can read the report right here.

Study Tracks Value-based Trend

Value-based care and payment programs have reached nearly all states, according to a study published by Change Healthcare. The national study of state healthcare payment programs examined progress made in the last 18 months. Researchers found that the number of states implementing these programs has increased sevenfold in the last five years. In total, 48 states and territories, including the District of Columbia and Puerto Rico, have implemented them. Half of the implemented initiatives are multipayer in scope, according to the study. Eight states are in the early stages of developing value-based payment strategies, and six have implemented such strategies for four years or longer. Thirty-four states have initiatives two or more years into implementation. More info here.

WA Commissioner Cracks Down on Pet Insurers and One SF-Based Broker

Washington State Insurance Commissioner Mike Kreidler issued fines totaling $158,000 against insurance companies, agents and brokers — including San Francisco-based Socius Insurance Services, Inc. — who violated state insurance regulations when selling pet insurance. In July 2018, Kreidler fined United States Fire Insurance, the company that sells pet insurance under the brand name ASPCA Pet Health Insurance, $50,000 for several law violations, including charging customers the wrong rate, selling policies through unlicensed producers, issuing incorrect policy forms to customers and not disclosing the underwriter’s name to customers. At the time, Kreidler suspended $25,000 of the fine as long as the company followed a compliance plan to correct the violations. The commissioner determined that the company wasn’t complying with the plan and he levied the $25,000 on that company, in addition to fining the others.

CVS Caremark Wants You to Know

CVS is tooting its horn over its role in helping customers fight high prescription drug costs. According to a recent release, in 2018, CVS’s PBM solutions “blunted the impact of drug price inflation achieving a negative -4.2 percent price growth for non-specialty drugs and a 1.7 percent price growth for specialty drugs.” The company contends that 44 percent of its commercial PBM clients saw net prescription drug prices decline from 2017 to 2018. CVS Caremark credits managed formularies for helping them advantage of market competition on behalf of PBM clients. In 2018, clients that adopted their managed formularies saw savings of nearly 14 percent per 30-day prescription, even as drug price inflation grew four times faster than overall inflation.

NAIC to Take on LTC

The National Association of Insurance Commissioners announced it will create a task force focused on long-term care insurance market stability. The group will report to the NAIC Executive Committee. The first meeting of the Long-Term Care Insurance Task Force is tentatively scheduled to be held in Kansas City during the NAIC Insurance Summit the week of June 3rd. Virginia Insurance Commissioner Scott A. White will chair the task force and Colorado Insurance Commissioner Michael Conway will serve as vice chair.

PCF Insurance Services Completes Acquisition of Grosslight Insurance, Inc.

Woodland Hills-based PCF, a full-service insurance brokerage, announced it has completed the acquisition of Grosslight Insurance, Inc., headquartered in the Westwood neighborhood of Los Angeles.

Grosslight Insurance, with offices in Westwood and Rancho Cucamonga, was founded in 1950 by Gil Grosslight who built the agency into one of the top twenty brokers in Los Angeles. Gil will continue to service his clients and the Grosslight brand will continue under PCF’s stewardship. More info here.

Best Report: Automatic Long-Term Disability Insurance Enrollment a Boon for DI

Disability folks will like this: A rule clarification that allow employers the option to provide long-term disability coverage to their employees through automatic enrollment should benefit insurers by increasing participation rates, and increased marketing efforts and evolving employee attitudes may boost sales, says a new A.M. Best report. A recent decision by the U.S. Department of Labor expands automatic enrollment programs in all states to include disability insurance plans, with an opt-out choice, preempting any state laws specifically banning auto-enrollment for the product. The Best’s Special Report “LTD Insurance Auto-Enrollment: A Potential Tailwind for Market Players,” states that from 2012 to 2017, net premiums written for group long-term disability (LTD) rose more than 30%, to $12.6 billion from $9.7 billion, while the number of covered lives grew 28%. Based on the experience of some insurers already offering the automatic enrollment option in certain states, participation rates could grow by 10% to 15%, with continued growth opportunities in the employer group space. The rule clarification likely will have a greater impact on insurers with more of a focus on larger accounts. You can access the full report here, but it will cost you.

WEBINARS

April 25 Webinar: Hodges-Mace, Strategic Benefits Advisors Team Up on How to Execute a Benefits Strategy

Join benefits administration experts Mike Ehrle, SVP of Strategic Partnerships, Hodges-Mace and Jay Schmitt, Principal, Strategic Benefits Advisors on April 25 at 10 a.m. PT as they discuss the merits of single HCM vs. best-in-breed point solutions as well as trends and innovative strategies in the benefits industry. Register here.

During the one hour webinar, “What’s All the Buzz About? Cutting through the Noise to Find the Right Solutions,” Mike and Jay will discuss engagement and efficiency solutions, share the pros and cons of adopting an all in one vs. best in breed benefits delivery platform and explain how a benefits consultant can help employers make the best decisions. Topics to include:

1) insights on the benefits technology trends

2) how the benefits evolution is impacting employers

3) why partnering with a benefits technology expert helps employers and those in HR make the smartest decisions to achieve company-wide employee benefits goals

AHIP Webinars

Get your viewing on with Association of Health Insurance Plans upcoming webinars:

Social Determinants of Health Through Nutrition

Thursday, April 18 | 9 a.m. – noon PT

More and more, health insurance providers are integrating strategies to address the social determinants of health. Studies show that improving access to better nutrition, especially for those with chronic conditions, is an effective way to reduce medical costs and improve overall health. Learn more and register.

Wednesday, May 1 | 10-11:00 a.m. PT

Health insurance providers and employers alike are bombarded by what seems like an endless supply of point solutions, creating chaos for both the organization in choosing what to offer to whom, as well as to members who must figure out how to navigate to the unique programs they need. Learn how health organizations can provide the same kind of on-demand, personalized experience that consumers have come to expect from other industries.Learn more and register.

Cost Optimization for Medicare Advantage Plans

Thursday, May 9 | 11 a.m.– noon PT

The Medicare Advantage market is becoming increasingly competitive, with three of the largest plans garnering 55 percent of MA enrollment and new plans entering each Annual Election Period. In order to grow, MA organizations must drive down administrative costs while exceeding member expectations. Learn about the use of technology and automation to reduce errors in the enrollment and claims processes, and how these operations are integral in creating an unparalleled member experience. Learn more and register.

CAHU Capitol Summit & Expo

May 20-22, Sawyer Hotel, Sacramento

Join CAHU in Sacramento at the Sawyer Hotel for information about California and the future outlook for the industry. Hear from Commissioner Lara, representatives from the Governor’s office, legislators, political insiders and more about where California is headed. Work alongside peers and other members as CAHU works to educate representatives on the critical role of the agent. Register here.

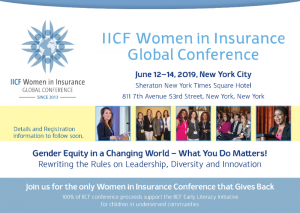

IICF Women in Insurance Global Conference

June 12-14, 2019, New York City

NAHU Annual Convention –We’ll see you here!

June 29-July 2, Sheraton San Diego Hotel & Marina

Keynote speaker is Retired Master Sergeant Cedric King. Sessions focus on practical solutions for your business, including retaining today’s new workforce, buying or selling your agency, data transparency and alternative healthcare management. And there’s an expanded Medicare Extreme! with proven practices and important trends on changes in Medicare, technology solutions, growing your business with group Medicare sales plus more. Plus plenty of opportunity to visit with a variety of vendors and network with colleagues More info here.